TOP GLOVE PROFIT MARGIN

It offers latex nitrile vinyl surgical household cleanroom cast polyethylene industrial high risk and thermoplastic elastomer gloves. Following the earnings revision he lowered Top Gloves target price to RM180 per share from RM260 previously based on a price earnings multiple of 22 times for 2023 earnings per share.

The Top Five Secrets Of A Successful Restaurant Five Ingredients Restaurant Food

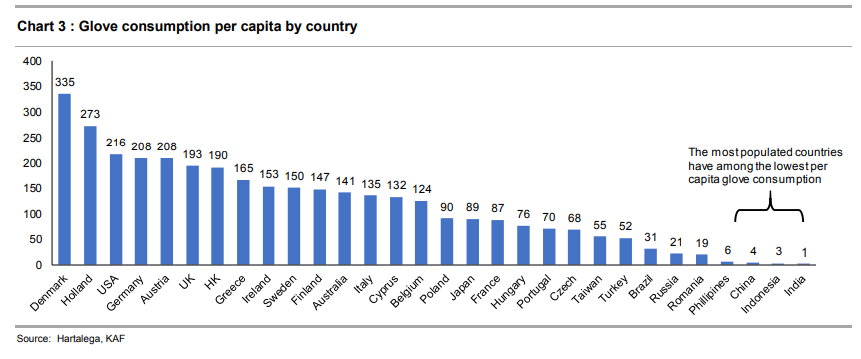

Top Gloves capacity on the other hand is probably more than 2 times Hartalega.

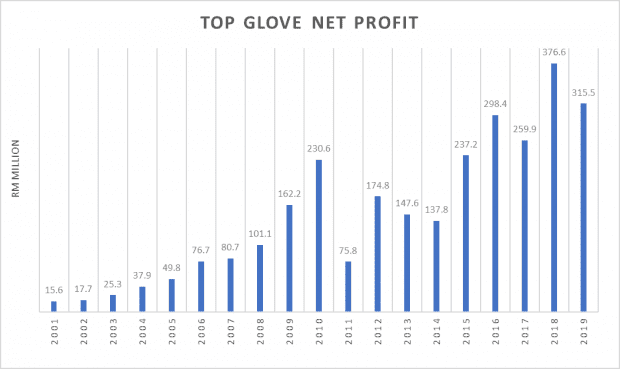

. Top Glove as stated achieved a net profit margin of 50 in 1QFY21 which begs the questions. Bhd annual income statement. We are able to see Top Gloves assets and EBIT have remained improving yearly till 2020.

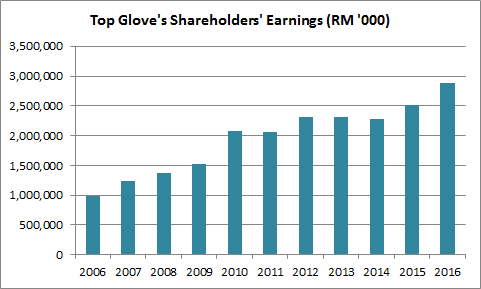

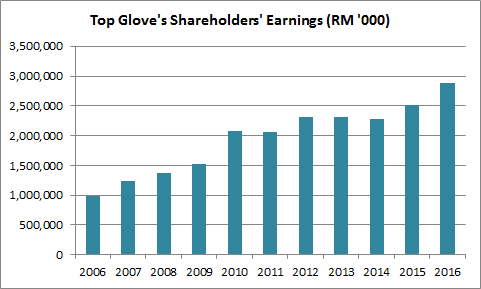

Top Gloves gross. 2345 As of Aug. Top Glove the worlds largest rubber glove company posted a massive RM787 billion net profit on the back of RM164 billion revenue in FY21.

Average natural latex concentrate prices were up by 8 percent to 153kg while nitrile latex prices increased marginally by 04 percent to 231kg quarter-on-quarter. The company turns out 48 billion gloves a year accounting for about a quarter of the global market. Is significantly lower than its historical 5-year average.

We expect to sign the sale and purchase agreement next month and the completion of the acquisition is targeted for February 2018 Top Gloves. Net profit-wise Hartalega Bhd emerges as the winner over Top Glove Bhd by more than 24. Comparison between Top Glove and Hartalega.

According to Top Glove raw material prices rose during the quarter affecting profit margins. According to Top Glove raw material prices rose during the quarter affecting profit margins. How long will this fat margin last.

Going forward Top Glove said raw material prices are expected to be on a downtrend. Top Glove Bhds Operating Income. 2021 View and export this data going back to 2011.

Operating Margin is calculated as Operating Income divided by its Revenue. TOP GLOVE EXPECTS TO MAINTAIN 10PCNT PROFIT MARGIN 21 March 2019 1203 KUALA LUMPUR. What about when demand for rubber gloves normalise.

Top Glove Corp Bhd is confident of maintaining an average profit margin of 10 backed by global growth in the glove market and an increase in the groups capacity. Operating profit EBIT 1. Hartalega Bhds net profit margin is at 16 while Top Gloves net profit margin is just at 766.

The current company valuation of Top Glove Corporation Bhd. Usually companies with this good improvement of sales EBIT and Assets would lead us to the inclined ROA and inclined profit margin but Top Glove wasnt the case despite 2020 growth as we can look at the ROA value driver analysis below. Average natural latex concentrate prices were up by 8 to RM631kg whilst nitrile latex prices increased marginally by 04 to 231kg quarter-on-quarter.

A company with high profit margins is also typically a safer investment than one with low profit margins. Top Glove which started out with three production lines now has about 500. The average consensus estimate of Top Gloves annual profit for FY22 is substantially lower at RM345 billion or roughly 4312 sen per share.

Is an investment holding company which engages in the manufacture and trading of rubber gloves. Top Glove Bhd Operating Margin. KUALA LUMPUR Dec 11.

View 7113MY financial statements in full including balance sheets and ratios. Is therefore way below its valuation average over the last five years. 12 rows Top Gloves latest twelve months gross profit margin is 627.

Top Glove Profit Margin. Going forward Top Glove said raw material prices are expected to be on a downtrend. Its founder and executive chairman Tan Sri Lim Wee Chai said the.

Third-placed Kossan Rubber Bhd has a net profit of RM. Start your Free Trial. Overall our FY21FY22FY23 net profit margin is reduced to 1178582 from 159108104 previously he said.

Over the past twelve months. Profit Margin Quarterly 1253 Operating Margin Quarterly. 22 rows Top Glove Profit Margin Quarterly.

Top Glove sees increase in profit margin in second half of 2020. As it is Aspion commands a healthy 30 gross profit margin on its business while Top Gloves own smaller surgical glove unit generates about 20 gross profit from sales. Pre-Tax Profit EBT 1.

Picture courtesy of Top Glove Corporation. As you can see Top Gloves margin are much smaller despite its revenue being more than 2 times Hartalega. The EVEBITDA NTM ratio of Top Glove Corporation Bhd.

The companys net profit jumped 93 per cent year-on-year y-o-y to RM11568 million in Q2 ended February 28 2020 from RM10579 million in Q2 2019. Profit margins of glove companies to come under pressure AmInvestment. Kenanga Research analyst Raymond Choo Ping Khoon also lowered its target price from RM360 to RM205 based on 18 times of 2022 earnings per share at pre-Covid five-year forward historical mean.

Top Glove Bhd has been profitable 10 over the past 10 years. AmInvestment Bank Bhd has maintained its Neutral rating on the glove sector and said it believes that selling prices and operating profit margins of glove companies will come under pressure due to a short-term oversupply in the industry. Balance Sheet - Both Top Glove and Hartalega are almost equally strong with minimal debt.

Investors Will Be Looking For More Than Another Record High Profit From Top Glove The Edge Markets

Defensive Growth Opportunities In Growing Medical Glove Market Seeking Alpha

Analysis Of Glove Companies In Malaysia 2020 27 Advisory

12 Things You Need To Know About Top Glove Corporation Before You Invest The Fifth Person

Profit Margins A Complete Guide For Small Business Owners Jobber Academy Small Business Small Business Owner Financial Health

Top Glove Makes The Highest Quarterly Profit Among Malaysia S Top 10 Companies Klse Screener

Project Management Metrics Template Project Management Powerpoint Templates Powerpoint

Pinterest Business How To Make Sales On Pinterest Pinterest For Business Pinterest Marketing Expert Pinterest Marketing

14 Things To Know About Top Glove Before You Invest Updated 2020

0 Response to "TOP GLOVE PROFIT MARGIN"

Post a Comment